Carmarthen-based, UK-wide service

LIMITED COMPANY BUY-TO-LET MORTGAGES — BORROW MORE AND STRUCTURE TAX-EFFICIENTLY

Specialist limited company mortgage advice using 170+ lenders — including solutions for SPV structures, portfolio landlords, and complex income cases

WHY LIMITED COMPANY LANDLORDS STRUGGLE TO BORROW MORE

Many landlords move to a limited company expecting better tax efficiency and smoother borrowing.

Instead, they’re offered less than expected — or declined — without a clear explanation.

Lenders assess limited company buy-to-let very differently from personal mortgages.

Stress testing, Interest Coverage Ratio (ICR) rules, and internal lender models often restrict borrowing — even when rental income looks strong and the portfolio is performing well.

This leaves experienced landlords injecting more capital than planned, scaling back purchases, or delaying growth — when the real issue isn’t the investment, but how the application is structured and where it’s placed.

This is where most limited company borrowing strategies quietly break down.

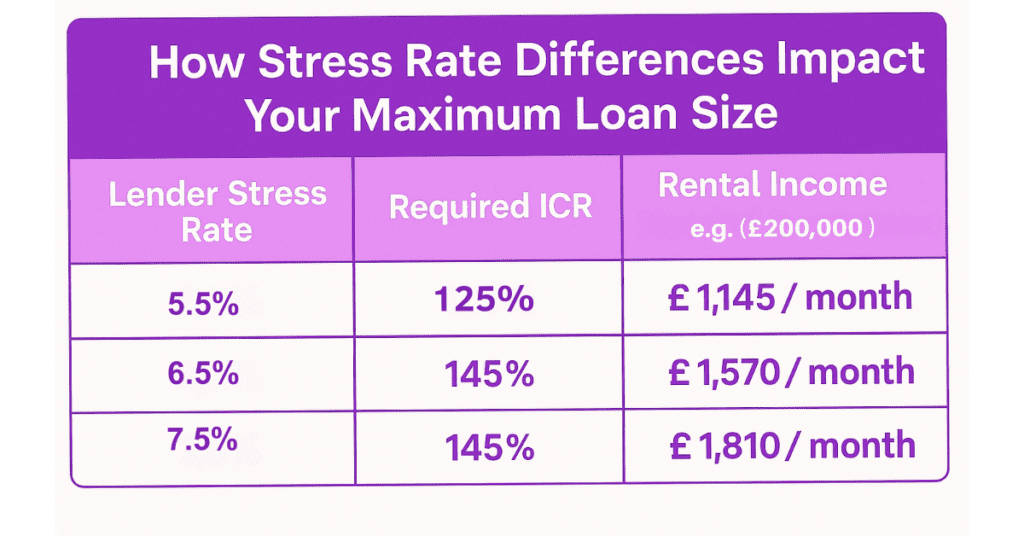

HOW LENDER STRESS TESTS AND ICR RULES RESTRICT LIMITED COMPANY BORROWING

Many landlords run into problems because:

• Stress rates can be set as high as 7.5%, even if you’re fixing at a much lower rate

• ICR thresholds can reach 170–175%, requiring significantly higher rental income

• You’re asked to reduce borrowing or increase your deposit, even when the numbers feel strong

• Refinancing or expanding your portfolio starts to feel frustratingly out of reach

SECURE YOUR NEXT LIMITED COMPANY MORTGAGE BY GETTING ICR RIGHT

I work with landlords applying through SPVs or limited companies who want clear, strategic advice to overcome borrowing restrictions — particularly when it comes to the challenges of the ICR test.

I don’t just look at what lenders require. I take the time to understand your wider financial picture, so your mortgage is structured to satisfy lender criteria, optimise your tax position, and align with your long-term business goals — all in a way your accountant would approve of.

Whether you’re expanding your portfolio or refinancing existing properties, I’ll help you navigate complex lending rules with tailored solutions that make financial sense — not just now, but in the years ahead.

Specialist Lenders

Use limited company-friendly lenders with flexible stress testing to unlock higher borrowing

Limited Company BTL

Align borrowing with accountant-approved tax strategies for scalable, long-term growth

Complex Income

Present company income, dividends, and rental figures clearly to avoid delays and rejections

Trusted by Landlords and Approved by Accountants

Real reviews from landlords who receive expert advice aligned with their accountants’ expectations

EXCELLENTTrustindex verifies that the original source of the review is Google. Lyndsey (West Wales Money) helped me get a tricky mortgage deal through and was fast and efficient. He kept me updated step by step and I'd highly recommend using him. I certainly will for my next purchase.Posted onTrustindex verifies that the original source of the review is Google. My mortgage needs were complex, but Lyndsey took the time to go through everything with care and professionalism. He explained my options clearly, guided me through each stage, and helped me secure the right mortgage. He always made himself available whenever I needed support. I’m extremely grateful for his help and would highly recommend West Wales Money.Posted onTrustindex verifies that the original source of the review is Google. Recently used West Wales Money to source a BTL Mortgage and the service was amazing, very professional, lots of communication and completed in record time, Will definitely use again 👍🏻Posted onTrustindex verifies that the original source of the review is Google. We simply wouldn't have been able to buy the house that we wanted without the solid, unbiased advice, provided to me by West Wales Money. Thoroughly recommended 👍Posted onTrustindex verifies that the original source of the review is Google. Would highly recommend West Wales Money to anyone looking for support to navigate the complex mortgage market, especially if you're a sole borrower. Lyndsey holds the knowledge and ability to seek out the correct mortgage available for you as an individual and guides you through the whole process consistently and carefully. Thank you.Posted onTrustindex verifies that the original source of the review is Google. Lindsey was very helpful with our mortgage; we found him very efficient with his work. Besides, he is a very nice, polite, and friendly person. Lindsey made every effort to work things out for us, and we are very happy with the result. After all, I would highly recommend him to anyone. As a matter of fact, I have already suggested him to one of my friends.Posted onTrustindex verifies that the original source of the review is Google. Lyndsey was invaluable in getting our mortgage, finding the best deal, handing all the document requests and overcoming issues with the mortgage provider's IT system. He understands the particular requirements for business owners or the self-employed in applying for residential mortgages and we would certainly use West Wales Money again.Posted onTrustindex verifies that the original source of the review is Google. I cannot thank Lyndsey enough for all the help and support he has given me with my remortgage, taking the stress out of a very stressful situation for me. He did exactly what he said he was going to do, when he said he would do it. The whole process has been so easy and this is completely down to Lyndseys professional attitude and to ensure that he provides a bespoke service for all his clients. He certainly delivered on that front. Nothing was too much trouble, he explained things clearly and ensured that I was completely clear of what was required and the costs etc before proceeding. I would thoroughly recommend Lyndsey at West Wales Money, and know that I will certainly be using his company and expertise again in the near future. Thank you again for helping me to not only to secure a mortgage , but for taking the stress of paperwork from me and making the whole process so easy. I really do appreciate it.Posted onTrustindex verifies that the original source of the review is Google. I used West Wales Money to explore getting a mortgage for a small holding that I wanted to buy. Lyndsey was really professional, friendly and went above and beyond to help me to get the right product. Sadly, we didn’t buy the property in the end, however I wouldn’t hesitate to go back to Lyndsey when the time comes. Highly recommended to everybody.

Expert Mortgage Advice for Landlords Using Limited Companies

📞 Want to Talk This Through?

Ready to discuss your mortgage needs? Call Lyndsey directly

Call: 07508 147884Hi, I'm Lyndsey!

When you’re borrowing through a limited company, the margin for error is small. The wrong lender, the wrong structure, or the wrong assumptions can limit borrowing, increase tax, or stall growth.

I provide specialist limited company buy-to-let mortgage advice for portfolio landlords across the UK, including company directors with complex income and growing portfolios.

You’ll deal directly with me throughout. I take time to understand your wider financial position and how lenders assess limited company borrowing — so your mortgage strategy works now and over the long term.

My mission?

To help landlords borrow smarter through their companies, reduce friction with lenders, and build sustainable portfolio growth — without unnecessary stress.

LIMITED COMPANY BUY-TO-LET REMORTGAGES

Many landlords refinance their limited company buy-to-let properties to reduce borrowing costs, release equity, and expand their portfolios.

Common reasons include:

✔️ Securing a lower interest rate when a fixed deal ends

✔️Releasing equity to fund the next investment property

✔️ Switching to a specialist lender better suited to limited company structures

✔️ Restructuring borrowing to support portfolio growth

As a specialist mortgage adviser, I help landlords compare lenders across 170+ mortgage providers, ensuring the remortgage works alongside their wider property strategy.

Whether you’re refinancing a single property or restructuring an entire portfolio, I’ll help you find a lender that understands limited company buy-to-let lending.

REAL LIMITED COMPANY BUY-TO-LET RESULTS

Case Study 1: Helping a Company Director Secure a Buy-to-Let Mortgage Through a Special Purpose Vehicle (SPV)

👩💼 Client Profile:

Gareth, a company director based in Carmarthenshire, was looking to expand his property portfolio by purchasing a buy-to-let through a newly established Special Purpose Vehicle (SPV). His income was a mix of a low salary, irregular dividends, and retained profits within the business.

⚠️ The Challenge:

• Gareth’s income structure didn’t fit the standard lending criteria used by high-street banks.

• He was unsure how to use his SPV for the mortgage and concerned lenders wouldn’t recognise retained profits.

• Several lenders had already turned him down or offered significantly reduced borrowing limits.

• Time was tight — the property had strong rental potential and was attracting competing offers.

🔍 My Solution:

I assessed Gareth’s income holistically, looking beyond salary and dividends to include retained profits. By accessing specialist lenders, I identified a lender comfortable with SPV structures and company director income profiles. I prepared the case with detailed documentation to clearly demonstrate affordability and the SPV’s setup.

✅ Outcome:

• Gareth was approved for the full loan amount at a competitive interest rate.

• The lender accepted his retained profits, enabling him to borrow more than traditional lenders had offered.

• The application was approved quickly, allowing him to secure the property ahead of other buyers.

• Gareth is now growing his portfolio and using the same SPV structure for future purchases.

💬 Client Testimonial:

“When your income doesn’t fit the high-street mould, expert advice makes all the difference. Lyndsey helped me unlock better borrowing through my SPV and secure the property without delay.” – Gareth, Carmarthenshire

Case Study 2: Expert Mortgage Advice Empowers a Buy-to-Let Landlord’s Investment Growth

👩💼 Client Profile:

Our client, a higher-rate taxpayer and experienced professional, owned a portfolio of five Buy-to-Let properties. With solid income and a goal to expand, he sought to remortgage one property—a single unit with four flats under one title—to fund a new investment.

⚠️ The Challenge:

This property structure posed challenges, as many lenders require separate leases for each unit. Additionally, as a higher-rate taxpayer, he needed a solution that maximised tax efficiency and investment return.

🔍 My Solution:

Drawing on my expertise in Buy-to-Let and access to specialist lenders, I identified a provider open to complex property structures. This approach enabled the client to successfully remortgage, unlocking capital for further investment.

✅ Outcome:

With the remortgage secured on competitive terms, he reinvested in his portfolio, increasing his long-term investment potential. He gained confidence and peace of mind, knowing he had a tailored strategy for continued growth.

💬 Client Testimonial:

“Lyndsey’s knowledge of the Buy-to-Let market and access to specialist lenders made all the difference. He helped me navigate a complex property setup and move forward with confidence.” – Portfolio Landlord, West Wales

NEW TO LIMITED COMPANY BUY-TO-LET? AVOID COMMON SETUP MISTAKES

Crafted with input from accountants and tailored for landlords

WHAT HAPPENS WHEN YOU BOOK A DISCOVERY CALL

Mortgage Advice in

4 Simple Steps

📞 Step 1: Book Your Complimentary Mortgage Review

Send an enquiry and I’ll give you a call to understand your situation and what you’re looking to achieve.

🔍 Step 2: I’ll Search Rates from Specialist Lenders

I compare fixed-rate deals across a wide panel of lenders — so you get a competitive rate that fits your needs and budget.

📝 Step 3: I’ll Handle the Application for You

No stress, no chasing forms — I take care of the paperwork and liaise with the lender on your behalf.

📦 Step 4: Relax While I Keep You Updated

You’ll receive regular updates throughout the process — all the way through to mortgage offer and completion.

Trusted Partners for Your Mortgage Needs

Discover Better Deals and Reduce Your Monthly Repayments Through Specialist Lenders

Accountant-Approved Limited Company Mortgage Advice to Borrow Smarter

🏠 Limited Company Buy-to-Let Expertise

Get one-to-one limited company buy-to-let mortgage advice tailored to your goals — with clear guidance, no jargon, and no pressure.

Book Your Limited Company Discovery Call

West Wales Money Ltd is registered with the Data Protection Act 2018 registration No ZA579253 and is authorised and regulated by the Financial Conduct Authority under Firm Reference No: 1005183 an Appointed Representative of TMG Direct Limited which is authorised and regulated by the Financial Conduct Authority under Firm Reference No: 786245 and registered with the Data Protection Act 1998 registration No: ZA178200.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on a mortgage or any other debt secured on it. The guidance and/or advice contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.