Carmarthen-based, UK-wide service

STAY IN THE HOME YOU LOVE – UNLOCK THE MONEY YOU NEED AFTER 50

Release funds, reduce financial pressure, and enjoy later life with confidence — without selling up or starting over

Find Out What You Could Borrow Today

✔ Confidential | ✔ No Obligation | ✔ FCA Registered

Flexible Age Requirements

Available to those 50+ with no age limit

Interest-Only Mortgages

Reduce your monthly mortgage costs

Remortgage Solutions

Unlock funds for a better retirement | Home improvements or debt consolidation

Proven Results for Clients Across the UK

Clients across the UK trust me for expert mortgage advice tailored to later-life needs. Here’s what they have to say

EXCELLENTTrustindex verifies that the original source of the review is Google. My mortgage needs were complex, but Lyndsey took the time to go through everything with care and professionalism. He explained my options clearly, guided me through each stage, and helped me secure the right mortgage. He always made himself available whenever I needed support. I’m extremely grateful for his help and would highly recommend West Wales Money.Posted onTrustindex verifies that the original source of the review is Google. Recently used West Wales Money to source a BTL Mortgage and the service was amazing, very professional, lots of communication and completed in record time, Will definitely use again 👍🏻Posted onTrustindex verifies that the original source of the review is Google. We simply wouldn't have been able to buy the house that we wanted without the solid, unbiased advice, provided to me by West Wales Money. Thoroughly recommended 👍Posted onTrustindex verifies that the original source of the review is Google. Would highly recommend West Wales Money to anyone looking for support to navigate the complex mortgage market, especially if you're a sole borrower. Lyndsey holds the knowledge and ability to seek out the correct mortgage available for you as an individual and guides you through the whole process consistently and carefully. Thank you.Posted onTrustindex verifies that the original source of the review is Google. Lindsey was very helpful with our mortgage; we found him very efficient with his work. Besides, he is a very nice, polite, and friendly person. Lindsey made every effort to work things out for us, and we are very happy with the result. After all, I would highly recommend him to anyone. As a matter of fact, I have already suggested him to one of my friends.Posted onTrustindex verifies that the original source of the review is Google. Lyndsey was invaluable in getting our mortgage, finding the best deal, handing all the document requests and overcoming issues with the mortgage provider's IT system. He understands the particular requirements for business owners or the self-employed in applying for residential mortgages and we would certainly use West Wales Money again.Posted onTrustindex verifies that the original source of the review is Google. I cannot thank Lyndsey enough for all the help and support he has given me with my remortgage, taking the stress out of a very stressful situation for me. He did exactly what he said he was going to do, when he said he would do it. The whole process has been so easy and this is completely down to Lyndseys professional attitude and to ensure that he provides a bespoke service for all his clients. He certainly delivered on that front. Nothing was too much trouble, he explained things clearly and ensured that I was completely clear of what was required and the costs etc before proceeding. I would thoroughly recommend Lyndsey at West Wales Money, and know that I will certainly be using his company and expertise again in the near future. Thank you again for helping me to not only to secure a mortgage , but for taking the stress of paperwork from me and making the whole process so easy. I really do appreciate it.Posted onTrustindex verifies that the original source of the review is Google. I used West Wales Money to explore getting a mortgage for a small holding that I wanted to buy. Lyndsey was really professional, friendly and went above and beyond to help me to get the right product. Sadly, we didn’t buy the property in the end, however I wouldn’t hesitate to go back to Lyndsey when the time comes. Highly recommended to everybody.Posted onTrustindex verifies that the original source of the review is Google. Excellent service from start to finish

Ready to explore your mortgage options after 50? Let’s talk

Why Even Strong Over-50s Get Declined – and How I Help

Even if you have a good income, savings or pension, lenders often still say no

Here’s why – and how I work around i

✔ Lenders don’t accept your pension or investment income.

✔ Interest-only repayments are declined without a rigid repayment plan.

✔ You’re offered poor deals because you’re over a certain age.

⚡ If this sounds familiar, it’s not your fault – it’s just that most lenders don’t understand later-life borrowers. That’s where my specialist advice makes all the difference.

Who This Is Ideal For

✔️ Clients with pension drawdown, investment income or part-time earnings

✔️ Homeowners with interest-only mortgages reaching term

✔️ Anyone who wants to avoid selling or downsizing

✔️ Borrowers aged 50 to 90+

How I Make Mortgages for Over 50s Simpler — and Smarter

🔍 Tailored advice built around your retirement income Whether you draw from pensions, investments or part-time earnings, I match your mortgage to your actual financial position.

🏡 Specialist lenders for later-life borrowers Access to specialist lenders who understand pension income, flexible affordability, and future downsizing plans.

🧡 One-to-one support – no call centres You deal with me directly. Personal, transparent, expert advice from start to finish.

🧠 30+ Years Helping Clients Like You. From lifetime mortgages to short-term remortgages, I’ve helped hundreds of people over 50 secure the right deal with confidence.

Keep your home, not sell your home

Lower monthly payments

Borrow into retirement with confidence

Why Work With a Specialist Later-Life Broker?

“Hi, I’m Lyndsey!”

✔️ 30+ years’ experience helping clients across the UK

✔️ Specialist knowledge of over 50s, later life and retirement mortgages

✔️ Access to lenders who go beyond the high street

✔️ A personal, one-to-one service

✔️ Clear answers and guidance without jargon

My mission?

Simplifying mortgages for over 50s!

Let’s Simplify Your Mortgage for Over 50s in Just 4 Steps

Mortgage Advice in

4 Simple Steps

📞 Step 1: Book Your Complimentary Mortgage Review

Send an enquiry and I’ll give you a call to understand your situation and what you’re looking to achieve.

🔍 Step 2: I’ll Search Rates from Specialist Lenders

I compare fixed-rate deals across a wide panel of lenders – so you get a competitive rate that fits your needs and budget.

📝 Step 3: I’ll Handle the Application for You

No stress, no chasing forms – I take care of the paperwork and liaise with the lender on your behalf.

📦 Step 4: Relax While I Keep You Updated

You’ll receive regular updates throughout the process – all the way through to mortgage offer and completion.

The Over-50s Guide to Interest-Only Mortgages

Borrow More, Stay Independent, and Keep Your Home

Case Study of Mortgages for Over 50s

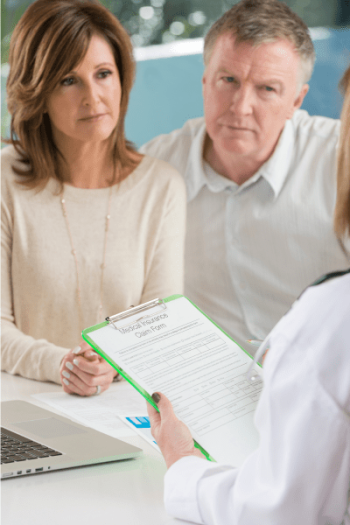

Case Study 1: Helping Chris and Sue Regain Financial Freedom

👩💼 Client Profile:

Chris and Sue, both aged over 50, wanted flexible borrowing options to support their retirement lifestyle without downsizing.

⚠️ The Challenge:

• Struggled to find lenders offering mortgages into retirement

• Wanted to access equity while keeping monthly repayments low

• Needed flexible terms that respected their pension and investment incomes

🔍 My Solution:

• Matched them with a specialist later-life lender offering flexible affordability assessments

• Secured a flexible mortgage allowing interest-only payments to reduce outgoings

✅ Outcome:

• Chris and Sue stayed in their family home without financial pressure

• Lower monthly repayments gave them greater freedom to enjoy life and travel

• Peace of mind knowing they had a tailored solution for their needs

💬 Client Testimonial:

“Lyndsey made everything clear, easy, and stress-free. We’re so grateful for the personal service and brilliant outcome!”

– Susan, Pembrokeshire

Trusted Partners for Your Mortgage Needs

Access Better Deals and Reduce Your Monthly Repayments with Tailored Mortgage Options from Specialist Lenders

Discover Your Mortgage Options After 50

Providing tailored mortgage solutions for borrowers over 50 – including interest-only and later-life options designed around your goals.

Call me today on 01267 887434 or book your review

West Wales Money Ltd is registered with the Data Protection Act 2018 registration No ZA579253 and is authorised and regulated by the Financial Conduct Authority under Firm Reference No:1005183 an Appointed Representative of TMG Direct Limited which is authorised and regulated by the Financial Conduct Authority under Firm Reference No: 786245 and registered with the Data Protection Act 1998 registration No: ZA178200.

YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP REPAYMENTS ON YOUR MORTGAGE.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on a mortgage or any other debt secured on it. The guidance and/or advice contained within this website is subject to the UK regulatory regime and is therefore targeted at consumers based in the UK.