Carmarthen-based, UK-wide service

Fixed Rate Mortgages Made Simple

Secure a low fixed rate mortgage and protect yourself from rising interest rates

Submit Your Details to Get a Call Back Today!

Expert Guidance at Every Step

Receive personalised advice from an experienced mortgage specialist.

Same Day Mortgage Approval

Quick approval from 170+ lenders – save time and money with a reliable fast-track service.

Flexible appointments

Online appointments are available and meetings outside normal working hours.

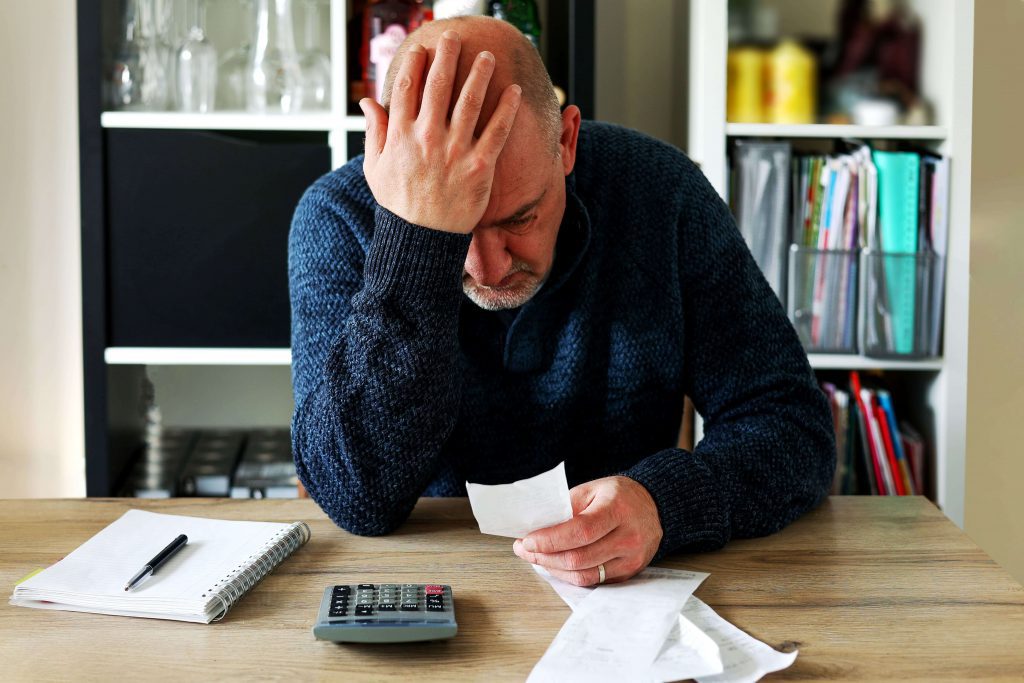

The cost of living crisis!

As the cost of living soars, driven by rising prices on essentials, households across the UK are under pressure. With inflation at record highs, the Bank of England is raising interest rates, making borrowing more costly. For those with variable-rate mortgages, this could lead to sudden and unaffordable payment increases.

Why a Fixed-Rate Mortgage Makes Sense

A fixed-rate mortgage offers a crucial advantage in these uncertain times: stability. Here’s why locking in a fixed rate could be a smart move:

- Protection from Rate Hikes: Your interest rate stays the same, regardless of future rate increases, ensuring your payments remain predictable.

- Budget Confidence: With fixed payments, you can plan your finances more effectively, even as other costs rise.

- Long-Term Savings: While fixed rates may start slightly higher, they could save you money in the long run if rates continue to climb.

- Financial Stability: A fixed-rate mortgage gives you control over your biggest expense, helping you maintain financial stability.

If your fixed-rate mortgage is expiring within the next 6 months, make contact now to lock in better rates!

A fixed-rate mortgage offers predictable monthly payments and protection against interest rate increases, saving you money make it a smart choice

Get Your Blueprint Guide to Fixed-Rate Mortgages

Mortgage advice in 4 simple steps

Here are the four simple steps to getting your mortgage:

- You enquire and get a call back for a free mortgage review.

- You will get better mortgage rates from over 170 lenders, saving you time and money.

- I will take the hassle out of submitting your mortgage application by doing it for you.

- Sit back and relax as I provide regular updates until the mortgage is completed and you receive the keys to your new home.

Hi, I'm Lyndsey!

My journey in the financial industry began over 30 years ago when my own search for a mortgage sparked a passion for the field. Since then, I have not looked back.

While the mortgage industry has evolved with the advent of new technologies, the fundamental commitment to providing exceptional service and finding the right mortgage solutions for clients remains unchanged.

My job allows me to guide people through the complex mortgage process, making a meaningful difference in their lives.

My mission?

Assisting homeowners in securing better fixed-rate mortgage deals to lower their monthly payments.

The Partners We Trust...

West Wales Money

Unit 4 St Catherine’s Walk

Carmarthen

SA31 1GA

West Wales Money Ltd is registered with the Data Protection Act 1998 registration No ZA579253 and is authorised and regulated by the Financial Conduct Authority under Firm Reference No:1005183 an Appointed Representative of TMG Direct Limited which is authorised and regulated by the Financial Conduct Authority under Firm Reference No: 786245 and registered with the Data Protection Act 1998 registration No: ZA178200.