The Magic of Mortgage Research

Have you ever considered how much you could save by working with a mortgage broker? Let me share a story about a recent client who saved over £3,300 thanks to thorough mortgage research! Meet John and Emily John and Emily are a young couple excited about buying their first home in Swansea. With a decent […]

Remortgage: Your Shortcut to a Financially Brighter Future

Introduction A remortgage means getting a new mortgage to replace your old one. This can help you save money and get you a better remortgage deals to reduce your mortgage repayments. In this blog, we’ll explain more about remortgages and their benefits What is remortgaging? Remortgaging involves switching your existing mortgage to a new […]

Mortgage Protection: Safeguarding Your Home and Family

Imagine being signed off work tomorrow due to illness or injury — how long would your savings really last? For many families, it wouldn’t be long before mortgage payments and everyday expenses became a serious worry. Your home is more than bricks and mortar; it’s stability, security, and your family’s future. Protecting it is just […]

Why You Need Income Protection

Protecting Your Income for You and Your Family Life is unpredictable. Imagine if illness or injury prevented you from working. How would you cover your bills and daily expenses? This is where income protection insurance comes in. It ensures that you continue receiving an income when you’re unable to work due to illness or injury. […]

Mortgage Overpayment: The £100pm Secret

The £100 Mortgage Overpayment Strategy In personal finance, small changes can make a huge difference. One such change is the £100 mortgage overpayment strategy. It may not sound like much, but adding just £100 to your monthly mortgage payment can have a substantial impact on your mortgage balance and future finances. Let’s explore how this […]

How Company Directors Can Secure a Mortgage with Bad Credit

Introduction Are you a company director with bad credit finding it nearly impossible to secure a mortgage? 😢 Don’t worry—I’m here to guide you through the strategies to secure a mortgage, even if you’re self-employed or managing a complex income structure. This guide will help you understand the ins and outs of obtaining loans with […]

A Director’s Guide on How to Improve Your Credit Score

Are you a company director looking to buy a property but struggling with a bad credit history? If so, you might be wondering how to improve your credit score and get approved for a mortgage. You are not alone. Many directors face the same challenge, especially if their companies have gone through financial difficulties in […]

Navigating Mortgages for Directors with Complex Income

Are you a company director facing challenges in securing a mortgage due to a complex income structure? You’re not alone. Many directors struggle with income verification, particularly when their earnings consist of a mix of salary, dividends, and profits. This blog will explore the hurdles company directors often encounter and how working with a specialist […]

Mortgage Rate Cuts 2024: Your Guide to Locking in the Best Deals Now!

The world of mortgages has been shaken in 2024 as current mortgage rates have seen a significant drop. This shift brings new opportunities for homeowners and potential buyers alike. But what has led to this reduction in mortgage interest rates, and how can you take advantage of it? Let’s explore the key factors that have […]

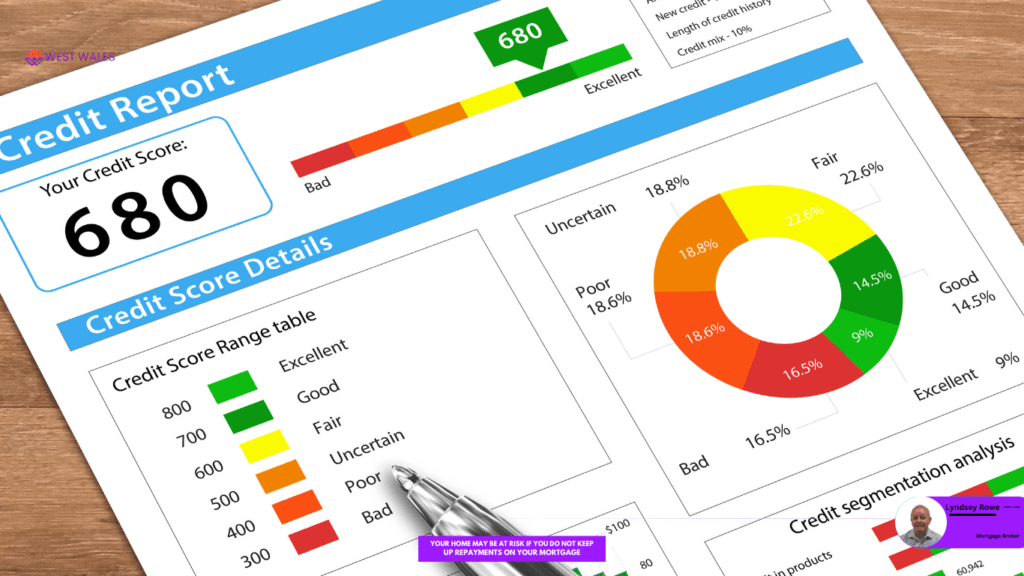

The Power of Your Credit Score

Why Your Credit Score Matters Your credit report reflects how well you manage your finances. It can impact your ability to borrow money, obtain a credit card, or even rent a home. But what is a good credit score, and how can you improve it? Here’s why it matters and some tips on how […]